The Best Guide To Guided Wealth Management

The Best Guide To Guided Wealth Management

Blog Article

Some Known Incorrect Statements About Guided Wealth Management

Table of ContentsThe Facts About Guided Wealth Management UncoveredGuided Wealth Management Can Be Fun For AnyoneThe Buzz on Guided Wealth ManagementThe 4-Minute Rule for Guided Wealth ManagementNot known Details About Guided Wealth Management Our Guided Wealth Management Ideas

Choosing an efficient economic advisor is utmost vital. Do your study and spend time to evaluate prospective financial experts. It serves to place a big effort in this process. Carry out an exam amongst the candidates and pick the most qualified one. Consultant functions can vary relying on a number of aspects, consisting of the type of economic consultant and the client's needs.For instance, independent recommendations is objective and unlimited, yet restricted advice is limited. Consequently, a restricted advisor should state the nature of the restriction. If it is vague, extra questions can be elevated. Conferences with clients to review their funds, allotments, needs, income, expenses, and prepared objectives. wealth management brisbane. Providing ideal plans by analyzing the history, financial data, and abilities of the customer.

Giving tactical plan to collaborate individual and business finances. Leading customers to apply the monetary strategies. Reviewing the applied plans' efficiency and updating the implemented intend on a regular basis on a normal basis in various stages of clients' development. Regular surveillance of the financial portfolio. Maintain tracking of the client's activities and validate they are following the appropriate course. https://www.intensedebate.com/people/guidedwealthm.

If any kind of issues are come across by the management consultants, they iron out the origin and solve them. Construct a monetary risk assessment and assess the prospective impact of the risk. After the conclusion of the danger analysis design, the consultant will certainly examine the results and offer a suitable solution that to be executed.

Not known Factual Statements About Guided Wealth Management

In the majority of countries experts are utilized to conserve time and decrease anxiety. They will aid in the accomplishment of the financial and workers goals. They take the responsibility for the offered decision. Consequently, customers require not be concerned regarding the choice. It is a long-term process. They need to research and examine even more areas to line up the best course.

Numerous actions can be contrasted to recognize a qualified and experienced advisor. Typically, advisors need to satisfy standard scholastic certifications, experiences and qualification advised by the government.

While seeking an advisor, please consider credentials, experience, skills, fiduciary, and payments. Search for clearness till you obtain a clear idea and full complete satisfaction. Constantly ensure that the advice you obtain from an expert is always in your benefit. Ultimately, economic consultants maximize the success of a company and likewise make it grow and flourish.

How Guided Wealth Management can Save You Time, Stress, and Money.

Whether you need somebody to help you with your tax obligations or stocks, or retirement and estate planning, or every one of the above, you'll discover your response here. Maintain reading to discover what the distinction is in between a monetary expert vs planner. Basically, any type of professional that can help you manage your cash in some fashion can be thought about a monetary consultant.

If your objective is to produce a program to meet lasting financial objectives, after that you possibly desire to enlist the solutions of a certified monetary planner. You can look for an organizer that has a speciality in tax obligations, investments, and retirement or estate preparation.

A monetary consultant is merely a wide term to define an expert that can aid Check This Out you handle your money. They may broker the sale and acquisition of your stocks, manage investments, and assist you produce a detailed tax or estate plan. It is necessary to keep in mind that a monetary consultant needs to hold an AFS license in order to offer the public.

A Biased View of Guided Wealth Management

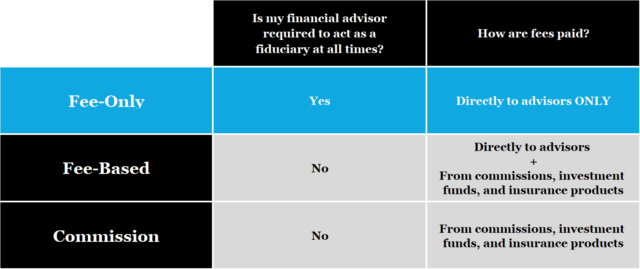

If your financial advisor lists their solutions as fee-only, you ought to expect a checklist of solutions that they provide with a malfunction of those fees. These specialists don't use any kind of sales-pitch and normally, the solutions are reduced and dry and to the point. Fee-based consultants charge an upfront fee and after that make commission on the monetary products you buy from them.

Do a little study first to be certain the economic expert you work with will be able to take care of you in the long-lasting. Asking for recommendations is an excellent method to obtain to know an economic expert prior to you also meet them so you can have a better concept of just how to manage them up front.

10 Simple Techniques For Guided Wealth Management

You ought to constantly factor prices right into your financial planning scenario. Very carefully review the cost frameworks and ask inquiries where you have confusion or worry. Make your prospective consultant respond to these questions to your satisfaction prior to relocating forward. You might be seeking a specialty expert such as somebody that concentrates on separation or insurance coverage preparation.

An economic consultant will certainly help you with setting achievable and sensible objectives for your future. This could be either starting a company, a family members, preparing for retired life all of which are necessary phases in life that require careful factor to consider. A monetary expert will certainly take their time to review your circumstance, short and long term objectives and make referrals that are appropriate for you and/or your family members.

A research study from Dalbar (2019 ) has illustrated that over two decades, while the typical financial investment return has actually been around 9%, the ordinary capitalist was only getting 5%. And the distinction, that 400 basis factors annually over two decades, was driven by the timing of the investment choices. Handle your profile Safeguard your assets estate preparation Retirement preparing Handle your extremely Tax financial investment and monitoring You will certainly be required to take a risk resistance set of questions to supply your consultant a more clear photo to identify your investment property allowance and preference.

Your expert will certainly take a look at whether you are a high, medium or low threat taker and established up a property allocation that fits your danger resistance and capability based upon the info you have actually supplied. A high-risk (high return) individual might spend in shares and building whereas a low-risk (low return) person may want to spend in money and term deposits.

The 10-Second Trick For Guided Wealth Management

For that reason, the extra you save, you can pick to invest and build your wide range. When you engage a monetary consultant, you don't have to manage your profile (best financial advisor brisbane). This conserves you a great deal of time, effort and energy. It is crucial to have correct insurance plan which can give comfort for you and your household.

Having a monetary expert can be unbelievably valuable for several individuals, yet it is crucial to consider the advantages and disadvantages before making a decision. In this post, we will certainly check out the advantages and negative aspects of collaborating with an economic consultant to assist you choose if it's the right relocation for you.

Report this page